If you are a business owner or a paid employee, and are finding it hard to manage your monthly debt payments, expenses and taxes, then you might want to consider filing for bankruptcy. A bankruptcy lawyer will help you decide which option is the best for you. Is it chapter 7, chapter 13 or chapter 11? Your current financial position, previous debt servicing and future payment abilities will determine which option is the best for you.

A good bankruptcy attorney will delve into your financial information and find out which option is the best for you. At the office of JR Law, we have 24 years of experience in the field and will be able to help you with your bankruptcy consulting requirements.

There are some situations and events which will call for debt resolution with your creditors. There are solutions to these problems. You can keep your assets; stop the creditors from collecting from you; keep your ongoing business running and adjust your debt service so that your cash inflow and outflow is balanced; pay your employees; sell your assets without any recurring lien on them and restructure your debt. You can reorganize your payments in a way that they are affordable for you, taking you out of the financial lurch you may find yourself in.

While doing business, you probably have had to suffer an unforeseen loss, a large bad debt, an emergency in the family or if you were struck with a financial crisis due to bad demand of your product or service. Your employees, creditors and the IRS might not be able to sympathize monetarily and your obligation towards them will stand where it was.

In times like the above mentioned, a good bankruptcy lawyer is what you need to get your business back in shape. At JR Law, we do just that. We can help you in the following situations:

- Inability to pay sales or withholding tax

- Tax returns not filed

- Sale or purchase of a business

- Offer and compromise

- Issues pertaining to the creditor

- Protection or acquisition of business assets

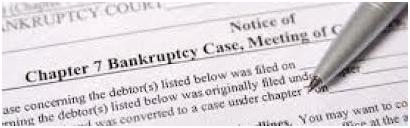

Addressing these financial problems of the owner is mostly the only way to make sure business stays healthy and viable in the long-term. If you file for Chapter 13 or Chapter 7 business bankruptcy, your business can get the protection it needs and a number of critical financial problems can be resolved, such as:

- Debt related to purchased or leased vehicles can be dismissed.

- Mortgages which are upside down can be decreased or ended. You can also get rid of second or third mortgages.

- Consolidation of credit card debt can be done along with its reduction or elimination.

- Consolidation, reduction and elimination of installment loans can be done.

- Improvement in cash flow can be attained.

- You can get your credit score or your income to debt ratio improved. Both these factors will determine your credit worthiness.

- You can relinquish any liability which may arise from existing or imminent lawsuits

- You can also get a lot of leverage when dealing with many kinds of tax issues.

At JR Law, we will help you draft a plan which will pay the creditors higher than what they would get if your company was to be liquidated. This seems more lucrative to creditors who are unsecure at the moment.

It does not matter what kind of chapter you file for bankruptcy, there is always a lot of paperwork and analysis to do. You have to be in a good position to offer an alternate payment plan to your creditors, otherwise a bad one can be easily dropped by the court, giving your creditors window of opportunity to repossess your assets.

There are a lot of documents to be collected, organized and filed, the sort which a lay man may not be able to handle. Also, you need to be wary of deadlines, or you can put your case in peril or go on pending for a long period of time. Therefore, it is best that you let a professional lawyer do the work for you. Contact JR Law and let us help you.